Working capital: an essential growth indicator for your business

You recently started up your business and your sales figures are growing at a steady pace? Even when business is flowing, don’t forget to keep an eye on your growth at all times!

Have you already determined the working capital you need for your business? If not, it’s not too late to calculate it. To ensure your company’s stability and to keep enough cash in reserve, here’s how to obtain accurate working capital based on your commercial needs.

What is working capital?

“Working capital” is the comparison that you obtain between the total amount of your current assets and that of your current liabilities. In other words, it is your ability to pay your bills, repay your debts and meet your short-term financial needs.

Working capital is an essential component to determining your business’s liquidity and financial health. If your working capital isn’t high enough, you risk not being able to pay your employees and your suppliers on time. You could also pay interest on your debts, indeed go bankrupt if your cash flow does not follow your growth.

To keep control over your company’s finances, it is essential to know how much money you have available to pay your bills. To determine this amount at a given moment, here is a simple calculation to make.

How do you calculate working capital?

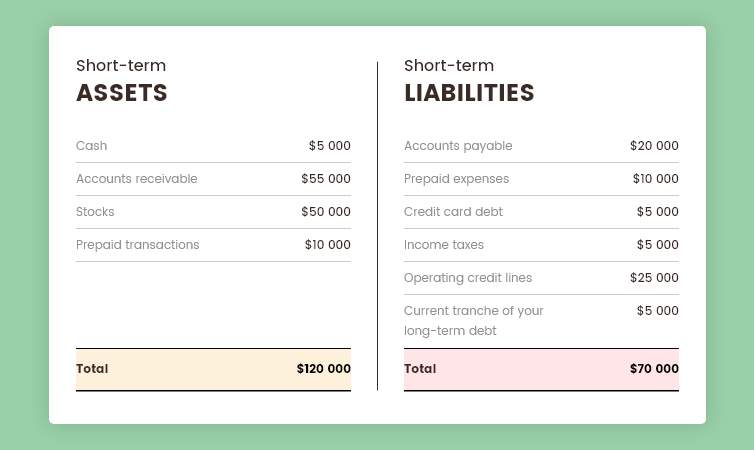

To calculate working capital, you must first add your short-term assets and short-term liabilities separately, then subtract the first amount from the second. The following example shows what you must include in this calculation:

In this example, you could benefit from a $50,000 working capital.

If you want to know the working capital that your business needs, you will have to do the same calculation shown above, but by dividing the first amount by the second. The result of this calculation is called “working capital turnover” and is made up of a whole number followed by several decimals. Based on the preceding example, you could obtain a ratio of 1.71.

The working capital turnover indicates the amount that you can use after having repaid each dollar of your current liabilities. This amount is very important, because it allows you to determine the proportion of liquidity that you can use in the short term. It therefore reflects your business’s general health and growth, in addition to your ability to manage financial difficulties or unforeseen issues.

How do you know if your working capital is healthy?

Even if a company is growing, it can sometimes quickly lack liquidity. Not only does good working capital depend on the number of products you sell, it also depends on the time that elapses between the time when you convert your liquidity into stocks and that where your stocks bring you the most money after their sale. This process is called “operating cycle”.

During the operating cycle, a shorter period could occur during the time when you use your cash to buy products to resell and the time when you can recover the amount of a sale. When this period becomes very long, your liquidity is immobilized for a longer time and cannot be used to repay your debts. The same situation applies to a services business if a customer pays you after you have paid your employees based on the hours calculated to offer the service.

To reduce the length of your business’s operating cycle, you can negotiate with your suppliers to try to get longer payment periods. This way, your business’s finances will fluctuate less and your working capital will flow better.

Did you know?

You can use the Acomba GO Project accounting module to monitor your expenses and bill your customers as you engage expenses for your products/services.

What to do if your working capital becomes negative?

When your working capital ratio is lower than 1, it is considered negative. You risk lacking resources to pay all your expenses or invest in your business. However, there are several solutions to get your finances back in order.

01 Improve your inventory management

You noticed that your working capital ratio is deteriorating little by little? The problem may come from your inventory management. If your products stay in the same place for a long time without being purchased, it may be that they are not being properly rotated.

To improve this rotation, take the time to perform the necessary analyses before ordering new stocks. For example, you could analyze the history of your product sales, the arrival of replacement products, the quantity already included in your inventory, etc.

02 Improve your accounts receivable management

Do certain customers often pay you late? To avoid this problem, you can, for example, offer a discount to your customers if they pay before a specified date. This idea will encourage them to pay faster.

Did you know?

You can use the Acomba GO Customers and Invoicing module to send invoices to your customers in just a few clicks and follow their invoicing history in real time. The ACCEO Transphere platform, compatible with Acomba GO, also allows your customers to view their invoices at any time and to pay you quicker by credit card or by bank transfer.

03 Get a small business loan

If your business has sales figures equal to or lower than 10 million dollars, you can opt for a small business loan. The government of Canada offers a financing program where SMBs can obtain a maximum amount of $150,000 for their working capital from financial institutions. Therefore, you can inject more liquidity into your company and fulfil your short-term financial needs.

NOTE: agricultural businesses are not eligible for this type of loan. If you work in the agricultural field and you want to obtain a loan, view the Canadian Agricultural Loans Act program.

Don’t forget that government programs can be frequently modified over the years. Therefore, the eligibility conditions may have changed since this article was published. Nevertheless, do not hesitate to learn about the grants offered!

04 Sell unused assets

In some cases, if you need liquidity rapidly, it may be practical to sell property or assets that you are not using. This method also allows you to do away with additional expenses which will save you more money over the long term, such as maintenance or insurance premiums.

Acomba GO: a practical tool to improve your working capital

To get the working capital needed for your company’s growth, it is important for you to obtain the appropriate management tools. Why not benefit from the opportunity to automate your accounting processes and save time and money? Simplify and keep control of your finances anywhere and at all times, thanks to Acomba GO’s many intuitive functionalities!

This article is intended for educational purposes only and does not claim to provide any financial, fiscal or legal advice. To get advice adapted to your business, rely on a chartered professional accountant, who can help you bring your finances to the next level.

The Acomba blog is brimming with articles on business, IT and business management.

Subscribe so you don’t miss a thing!

I am already subscribed